He says, “NOBODY, no matter how able or well intentioned–not my broker, not my accountant, not the manager of my mutual fund, not my brother-in law–cares as much about my money as I do.” Amen to that! Yes, we attempt to deliver the very best in the dispensation of financial advice and to that end we devote countless hours in the process yet still, we are in a business for profit. Steven Forbes said it best…”both my father and I agreed there is more profit in selling financial advice than subscribing to it.” As advisors, we are not always right but we truly try to do the right things. Yet in the end, you are closer to your money than are we. Why? Because it’s your money.

Diversify

…that is, hold many asset classes simultaneously and further diversify within each class. Own stock, but hold various sectors of the market…some big cap, mid cap and small cap companies. Diversify even further with both domestic and foreign companies. Hold some ‘value’ and some ‘growth’ companies. Own bonds…some US Treasuries, high yield and high grade corporate bonds and some foreign bonds. For those who are tax conscious, use tax exempt municipal bonds. Then look to hard assets such as real estate, commodities and some alternative investments. There is no one single best investment. All of these classes have their day in the sun as well as the pit. They will rotate through cycles. The idea is to own investments that do not correlate with each other. Manage your assets from an aggregate and bottom line perspective rather than having to win every battle. It is winning the war that counts!

…that is, hold many asset classes simultaneously and further diversify within each class. Own stock, but hold various sectors of the market…some big cap, mid cap and small cap companies. Diversify even further with both domestic and foreign companies. Hold some ‘value’ and some ‘growth’ companies. Own bonds…some US Treasuries, high yield and high grade corporate bonds and some foreign bonds. For those who are tax conscious, use tax exempt municipal bonds. Then look to hard assets such as real estate, commodities and some alternative investments. There is no one single best investment. All of these classes have their day in the sun as well as the pit. They will rotate through cycles. The idea is to own investments that do not correlate with each other. Manage your assets from an aggregate and bottom line perspective rather than having to win every battle. It is winning the war that counts!

Investment Objectives

…identify objectives and a timeline before investing dollar one. You might say, “I have just one objective…make money.” Thanks! That doesn’t help. There are five specific objectives which need to be prioritized:

1. Preservation of Capital-Safety

2. Liquidity-Access Without Penalty

3. Income Production-Send Those Checks

4. Capital Appreciation-Growth

5. Tax Advantage-Pay The Least Amount to ‘Sam’ and the Governor

The priority of these objectives will change as life changes. For example, most of us will need income from our portfolios upon retirement but not during the accumulation phase. We will be more growth oriented in our youth (more risk) than when we are approaching retirement (more safety). Arbitrarily investing money without an objective is like setting out on a boat without a rudder.

Manage Risk

…this heading did not say avoid risk. In order to grow money, it is necessary to subject a portion of each portfolio to some risk and it is equally necessary to know your risk tolerance. There are many litmus tests or ‘what ifs’ which may be applied to assist in making that determination. While uncooperative markets can shake the most intrepid growth investors, most know the long term end objective is more important than the comfort of the ride. A way to think about risk is to board a train whose destination is one of your choosing, but the ride is bumpy…very bumpy at times, but you get there. If that bumpy ride disturbs you to the extent that it is costing sleep, then board a train whose ride is very smooth. The price you pay for that decision is…it probably won’t take you where you want to go. All investors must determine which is more important… the quality of the ride or the destination? Trading sleep for profit is a miserable way to accumulate wealth.

…this heading did not say avoid risk. In order to grow money, it is necessary to subject a portion of each portfolio to some risk and it is equally necessary to know your risk tolerance. There are many litmus tests or ‘what ifs’ which may be applied to assist in making that determination. While uncooperative markets can shake the most intrepid growth investors, most know the long term end objective is more important than the comfort of the ride. A way to think about risk is to board a train whose destination is one of your choosing, but the ride is bumpy…very bumpy at times, but you get there. If that bumpy ride disturbs you to the extent that it is costing sleep, then board a train whose ride is very smooth. The price you pay for that decision is…it probably won’t take you where you want to go. All investors must determine which is more important… the quality of the ride or the destination? Trading sleep for profit is a miserable way to accumulate wealth.

Timing

… “is all…but impossible” says Donnelly. There is never a good time or bad time to make a good long term investment. Market timers are luckier than good when they hit it right. They are often wrong. As the ol’ saying goes, “even a broken clock is right twice a day.” To reduce volatility, consider dollar-cost-averaging. This is a strategy whereby one invests regular amounts of money at regular intervals. It certainly does not eliminate risk or guarantee profit, but rather makes the ride a bit smoother under most circumstances. Like everything else in our lives, there is a trade off. If your investment runs to the upside, you’ll miss some of it. If you experience a downside, at least you are accumulating shares at lower prices and patience often pays off when conditions become more favorable. No guarantees from the management!

… “is all…but impossible” says Donnelly. There is never a good time or bad time to make a good long term investment. Market timers are luckier than good when they hit it right. They are often wrong. As the ol’ saying goes, “even a broken clock is right twice a day.” To reduce volatility, consider dollar-cost-averaging. This is a strategy whereby one invests regular amounts of money at regular intervals. It certainly does not eliminate risk or guarantee profit, but rather makes the ride a bit smoother under most circumstances. Like everything else in our lives, there is a trade off. If your investment runs to the upside, you’ll miss some of it. If you experience a downside, at least you are accumulating shares at lower prices and patience often pays off when conditions become more favorable. No guarantees from the management!

Plain Vanilla

…if considering an investment you do not understand, avoid it. There are many investment vehicles, strategies and tactics that are pretty straight forward. Assuming you have devoted a fair amount of time to studying an ‘opportunity’ and still cannot make sense of it, it is most likely that someone(s) does not want you to understand it. The same little principle applies to politics and legislation. This is a big red flag. I have found simpler is better, although some might say ‘simpler is the sure way to hell.’

Nothing is Forever

…Nancy takes issue with this statement and I’m always careful to amend it with, “except for us.” Silly girl! She could do a lot better! All investments go through cycles and it is important to know that today’s little darling is often tomorrow’s donkey and vice versa. Look at any chart demonstrating rotation of sectors. The former Chairman at Oppenheimer Funds, John Fossell, always invested his retirement plan with the year’s worst performing sector, annually. This is a prime example of ‘buy low, sell high.’ Over time, he did quite well. Again, no guarantees from the management!

…Nancy takes issue with this statement and I’m always careful to amend it with, “except for us.” Silly girl! She could do a lot better! All investments go through cycles and it is important to know that today’s little darling is often tomorrow’s donkey and vice versa. Look at any chart demonstrating rotation of sectors. The former Chairman at Oppenheimer Funds, John Fossell, always invested his retirement plan with the year’s worst performing sector, annually. This is a prime example of ‘buy low, sell high.’ Over time, he did quite well. Again, no guarantees from the management!

Wealth Accumulation

…one of my favorite topics. Let’s just say that wealth accumulation is not an event. It is a process. Rookie investors are often driven by Wall St. movies or a buddy’s success story in picking the right stock(s) at the right time which resulted in a ‘killing.’ This is good luck…not a plan. Regular investing in diversified asset classes and sectors is a better solution. To accumulate wealth one must be committed to that idea and disciplined enough to execute the strategy. If each of us set aside a fixed amount of money to invest with each paycheck and increase that amount with each pay raise by the same percentage, that pot starts to look like something over several years. Over many years, it becomes considerably more than just something. Each investor must determine the appropriate amount to commit. There is no set number. A good rule of thumb is to establish a percentage of each paycheck where it hurts a little, but does not deprive the necessities. The adage, “pay yourself first” works.

…one of my favorite topics. Let’s just say that wealth accumulation is not an event. It is a process. Rookie investors are often driven by Wall St. movies or a buddy’s success story in picking the right stock(s) at the right time which resulted in a ‘killing.’ This is good luck…not a plan. Regular investing in diversified asset classes and sectors is a better solution. To accumulate wealth one must be committed to that idea and disciplined enough to execute the strategy. If each of us set aside a fixed amount of money to invest with each paycheck and increase that amount with each pay raise by the same percentage, that pot starts to look like something over several years. Over many years, it becomes considerably more than just something. Each investor must determine the appropriate amount to commit. There is no set number. A good rule of thumb is to establish a percentage of each paycheck where it hurts a little, but does not deprive the necessities. The adage, “pay yourself first” works.

Insurance

…life, health, property, casualty, long term care, errors and omissions or disability insurance for any loss is a waste of money IF you have the WILL and MEANS to self insure. This is not a popular notion and will, no doubt, draw lots of criticism…especially from the insurance sales people. The only insurance worthwhile is ‘last to die’ where both spouses are insured but the policy does not pay until the last to die dies. This a very effective tool in saving a sizable estate from the ravages of taxes imposed upon heirs…especially when the policy is owned by an ‘irrevocable life insurance trust.’ I’ll wait to deal with the slings and arrows from detractors.

…life, health, property, casualty, long term care, errors and omissions or disability insurance for any loss is a waste of money IF you have the WILL and MEANS to self insure. This is not a popular notion and will, no doubt, draw lots of criticism…especially from the insurance sales people. The only insurance worthwhile is ‘last to die’ where both spouses are insured but the policy does not pay until the last to die dies. This a very effective tool in saving a sizable estate from the ravages of taxes imposed upon heirs…especially when the policy is owned by an ‘irrevocable life insurance trust.’ I’ll wait to deal with the slings and arrows from detractors.

Primary Residence

…for many, our homes have turned out to be our best investment. Remember, real estate is an investable asset class. The ‘however’ part of the equation is…I don’t have to paint my stock portfolio every few years, nor do I pay property taxes, home owners insurance premiums, a gardener, a pool guy, a roofer, a tree surgeon, a pest control service, earthquake insurance premiums, fire zone insurance premiums, flood insurance premiums, garage door service maintenance, hardscape maintenance, and the list goes on and is as long as my arm. ‘Nuff said!

Debt

…own assets that appreciate and rent (lease) assets that depreciate. NEVER borrow money to buy a depreciating asset. Borrowing is not a great thing for a host of reasons not the least of which is money is not free. Debt is generally expensive, but necessary for most of us…especially when buying a home, financing higher education or resolving an emergency where options are limited. Debt service (interest) is the killer, especially with credit cards. Try to zero out your balance at the end of each cycle which means use the card as a convenience rather than someone else’s piggy bank. If you can’t afford to 0 out at the end of each cycle, then you can’t afford to buy it.

…own assets that appreciate and rent (lease) assets that depreciate. NEVER borrow money to buy a depreciating asset. Borrowing is not a great thing for a host of reasons not the least of which is money is not free. Debt is generally expensive, but necessary for most of us…especially when buying a home, financing higher education or resolving an emergency where options are limited. Debt service (interest) is the killer, especially with credit cards. Try to zero out your balance at the end of each cycle which means use the card as a convenience rather than someone else’s piggy bank. If you can’t afford to 0 out at the end of each cycle, then you can’t afford to buy it.

It’s Different This Time

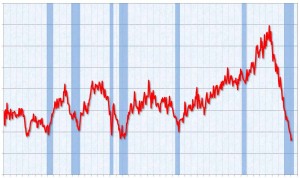

…nuh uh! It’s never different. Each time the market(s) goes into that dark place or we experience ‘irrational exuberance,’ there is always a gaggle of financial wizards who insist, “this time it’s different” inferring the apocalypse is upon us or the unprecedented boom has just begun. Remember the late nineties when any start up ‘dot com’ was a little darling even though they never made any money? Everyone on Wall St. was giddy and believed we were entering a “new paradigm.” After the bust, the word “paradigm” became a four letter one. It is EPS (earnings per share) that drives a company. Regardless of the calamity or confidence, markets find their way to reasonability over time. Remember the ’87 crash? It was a brief blip, but at the time it was believed to be the end of the world. We survived the .com bust of 2000, the terror of 911, the great financial crisis of ’08-’09, the possible unraveling of the EU, on going wars, etc. In spite of it all, we find solutions to these financial woes and work our way through. Betting against American capital markets historically is a bad bet….just don’t let your confidence get carried away.

…nuh uh! It’s never different. Each time the market(s) goes into that dark place or we experience ‘irrational exuberance,’ there is always a gaggle of financial wizards who insist, “this time it’s different” inferring the apocalypse is upon us or the unprecedented boom has just begun. Remember the late nineties when any start up ‘dot com’ was a little darling even though they never made any money? Everyone on Wall St. was giddy and believed we were entering a “new paradigm.” After the bust, the word “paradigm” became a four letter one. It is EPS (earnings per share) that drives a company. Regardless of the calamity or confidence, markets find their way to reasonability over time. Remember the ’87 crash? It was a brief blip, but at the time it was believed to be the end of the world. We survived the .com bust of 2000, the terror of 911, the great financial crisis of ’08-’09, the possible unraveling of the EU, on going wars, etc. In spite of it all, we find solutions to these financial woes and work our way through. Betting against American capital markets historically is a bad bet….just don’t let your confidence get carried away.

Concluding Remarks

…do not feel guilty when you neglect your personal finances. Chances are you are more productive when applying time and talent to yourjob/career/vocation/business. Most of us have earned more money and satisfaction through our work than our investments. Further, most investors rely on the expertise of financial/investment advisors. So, don’t sweat the small stuff.

…do not feel guilty when you neglect your personal finances. Chances are you are more productive when applying time and talent to yourjob/career/vocation/business. Most of us have earned more money and satisfaction through our work than our investments. Further, most investors rely on the expertise of financial/investment advisors. So, don’t sweat the small stuff.

…when markets are uncooperative as they are akin to be, take a deep breath and remember that your dog still loves you, and if your spouse loved you in the morning when you left the house, that will probably not change by the time you return home. Keep perspective on those things other than money that really matter.

…”budgeting is unnecessary if you live within your means.”

…don’t be a short term player, but rather become a long term investor.

…during your working years, your portfolio is where you put your money as you make it and not a source of supplemental income.

…if you are fortunate enough to become wealthy once, don’t make it necessary to do twice. Be Careful!

…the market is always right! Really? Yes, really! We have our doubts because we apply logic to a highly illogical marketplace. This is where we err. That is to say all transactions require both a buyer and seller. The strike price is agreed upon by both parties. Specific value assigned to an asset is what each party is willing to accept as fair market value resulting in an agreement. Every car you see on the freeway is the result of ‘fair price’ bargaining unless you are dealing with fraud. That ‘fair price’, be it high, low or in the middle is what both parties believe to be a good trade. Somewhat utopian, I’ll admit.

…money isn’t the only thing to consider when contemplating retirement. After answering the following three questions, you’ll know: Do I have something to do? Do I have something to love? Do I have something to hope for?

…Donnelly closes his piece with, “Despite all appearances, very few people of my acquaintance know what they are doing when it comes to investments or taxes. This is reassuring.”

…I’ll close mine by citing that not so quotable South Philly street philosopher, Dominick Marino (my dad) who said to my brother Jimmy and me, “Boys, let me tell yiz sompin’ about dat money ting… it makes good people betta and bad people woisa.” BRILLIANT! Thanks pop!

Disclaimer:

What you have just read is not to be construed as personal investment advice but rather my general observations. Consult with your tax adviser, investment adviser, banker, insurance professional and attorney for official and personal financial advice. Alfieland.com is my personal blog site and is not to be regarded as a professional one. Information provided in this piece is delivered in the spirit of amusement and entertainment. Again, consult with your professionals for personal investment/financial advice. Please take heed!

Hey Al! Nice read ! Thanks

Diego… thanks for your comment.