He wasn’t, and this promulgated a fair amount of ‘animated discourse’. I was abandoned, but in all fairness, this was Hank’s style and way of determining a new guy’s resourcefulness…maybe. It was not unlike learning to swim by being thrown into the deep end of a pool. If you’ve got the ‘stuff and incentive,’ you’ll figure it out. If not…you’re on your own, dude!

In the beginning, I was assigned a desk in the ‘bull pen.’ All of the experienced advisors worked in private offices, but not so for ‘newbies’ even though space was available. This is Wall St. ethos and way of saying, “you must earn the right to occupy an office.” I understood it and respected it…not much different than the pecking order in athletics. Fairly early in the game, I was getting in front of prospects with disposable income and investable dollars. This is ‘financial advisor nirvana’ and I desperately sought direction, counsel and mentoring but received little to none other than that which willingly came from Mr. Schneider. While Vic Schneider’s office time was limited due to his advanced age, he invited me to his home frequently, and frequently I went to seek the wisdom. But early on, it became apparent that success would be singularly dependent upon the trifecta of me, myself and I. I really got that.

My First Client

Ron Hull, my last office mate at the university, was my first client. He enjoyed the distinction of being labeled the “dirtiest college football player in America” while at UCLA in the early sixties by that infamous coach, Woody Hayes of Ohio State. Years later, Woody was fired for clocking a Clemson player during a bowl game…how’s that for irony? Coach Hull had Woody’s quote framed and displayed on a wall on his side of our office and proudly showed it to all who entered. Ron Hull was a teddy bear of guy (more bear than teddy). He was patient with me and wanted to know just how I might assist him with his retirement planning even though he continually reminded me that he had picked out his park bench and didn’t anticipate a dramatic increase in the price of pigeon feed and screw top wine. We were colleagues for 12 years and knew each other well but when money is involved, an entirely new dynamic comes into play. Ron said, “Al, I know you know a little something about kinesiology and gymnastics, but I don’t know what you know about money.” That comment was very telling in many ways. First, it provided me with some real insight into ‘client think.’ This is a trust issue. Not so much as to… ‘are you going abscond with my largesse’ as much as, ‘can I trust your financial judgment’? Once again, I became a student…only this time it was of capital markets.

After what seemed to be a dozen or so Ron Hull meetings, I finally wrote my first ticket. It was a $2,000 IRA contribution into Kemper’s US Government Securities Fund. A change in my presentation provided the impetus for Ron to make that investment. I had been telling him how the watch was made when all he really needed was the time. This was not unlike coaching high school gymnastics. The teacher/coach must make complex subject matter as simple as possible while still being accurate and thorough. Explanations to horizontal bar gymnasts like…”you must increase the radial acceleration around the horizontal axis of the bar so that you may create sufficient force in order to dismount with your center of gravity over the base,” are not very helpful. Similarly, once Coach Hull and I talked about an anticipated outcome (including risks, costs, etc. just in case FINRA is listening), the technical stuff seemed less important. I learned that most clients do not want labor pains; they want babies (engineers excepted).

My compensation for that trade was $40. It was then I realized what was obvious to the grey beards…this is a tough f***** business, and you’ve got to be a tough muthaf***** to survive. It would take a ton of IRA sales to make a living. This was both frightening and overwhelming. That same evening while alone at my desk, I sunk my face into my hands and began weeping. I had never done that…EVER! I desperately wanted to do this business the right way, but $40? C’mon man! I learned early in my coaching career to avoid chasing wins but rather to concentrate on the process and the wins will come. I wondered if the same axiom might be applied to my new venture, and now that I am a grey beard, I know this to be true. Coaches and financial advisors have more in common than one may think. Both live in highly stressful environments; both are highly competitive; both require accountability; both publish their results daily for the world to judge and both rely on brutally frank and unambiguous metrics to measure performance. Chasing wins in one case and dollars in the other may yield short term positive results, but becoming technically expert in both venues make for a long term, valued and trusted ally in that challenge to achieve. When financial advisors reach that station, the dollars become the ancillary by-product of that effort. Kevin Costner said it best in “Field of Dreams”…”build it and they will come.” That is when I began to really go to work.

There were five other advisors in our office and I was the kid at age 42. These dudes were pretty old! While I did engage them regularly as a sounding board, their advice was generally about finding and creating the next trade. I was interested in something else…like learning how to become of real value to a client where I may provide sound financial advice and direction. I wanted to assist clients in prioritizing objectives; establishing an investment policy; recommending an asset allocation; suggesting a product mix then executing a strategic plan designed to achieve those objectives. This is the essence of that process, and I wanted to get very good at it.

Spousal Support…not alimony

Without Nancy’s support, success would have been impossible. I was embarking on a new career at mid life and did not know if I could survive. What I needed is just what my “spousal unit” delivered…no social demands on my time. Prior to embarking into this brave new world, I said to Nancy, “If I make this commitment, I’m going to take deep breath and not come up for air for three years and I need to know you are OK with this.” In essence, this would now become my only priority behind family. One of the advantages of coming into our profession at mid life was the fact that our daughter, Danielle was now 20 years old and this freed up considerable time. As I reflect back upon those days, Nancy intuitively understood what was required and knew that I would approach this venture similar to my coaching career. Next to family, this enterprise trumped all else. When I was considering this change, Nancy and I spoke often about the challenges we would face relative to time, money, family, recreation, health, etc. I really did ask if she was OK with this and her response was predictable when she said, in a very serious but sincere way, “Al, do what makes you happy. I’ll live with you in a tent if need be.” Her response meant everything to me. I had her unconditional love and support. Not every advisor with whom I have been associated has been as fortunate on that score.

The First Five

…my first year out, I sought and found my groove. This is highly unusual for rookies. Grey beards always chuckle when rookies ask, “what is the most difficult part of money management?” Our answer is a standard one…”it’s getting the money to manage.” I didn’t have that problem for a variety of reasons: I wasn’t a kid; I had former colleagues with whom to speak; I was experienced in demystifying complex content; I was accustomed to communicating effectively with individuals and groups; I had academic credentials; I was ‘established,’ and what might be subliminally important, I never permitted anyone to see me sweat, and sweat I did. Big Time!

All teachers/coaches have the opportunity to augment their STRS or Cal PERS pensions by participating in 403(b) retirement plans where one may shelter a portion of salary into a tax deferred savings vehicle. Most advisors and investors used ‘plain vanilla’ fixed annuities as their investment of choice. I was licensed to offer tax sheltered annuities (TSAs) but chose to use mutual funds instead. This was a game changer. Most TSA sales people were not licensed to offer securities (mutual funds) and those who were had difficulty convincing their broker/dealers to engage in selling agreements with mutual fund companies. DSI did not have that problem and eventually, all of Wall St. got in line. If you thought the powers to be were initially resistant to the idea of equity investment in these retirement plans because of their concern for investor safety, please remember these are the same folks who brought you ‘derivatives’…also known as ‘financial weapons of mass destruction’! They were resistant because few did it and it was considered ‘unconventional’.

Once at it full time, my practice began to grow steadily due to 403(b) business and it led to referrals which led to more referrals which led to assets other than retirement plans. As a result, I enjoyed an exponential expansion which continued for the next 22 years. When preparing for licensing, Vic Scheider said something very prophetic to me…”you’ll know in six months if you have made a good career choice but it may take three years before you see any results derived from your effort.” He was half right. I knew I made a great choice within six months. To my surprise and delight, I actually doubled my university income during that first year. That’s the half that was not right, but certainly to my advantage.

My friend Roger, an E.F. Hutton advisor at the time, referred a client to me when he said his back office couldn’t handle a 403(b) rollover and asked if I may assist. To this day, I believe Roger was just being good guy by throwing me a bone as a ‘newbie’. His client was in a panic about creating a taxable event which was easily avoidable by executing a rollover into an IRA within 60 days. He was at his 55th. It was a simple transaction. The result was a successful rollover of a tidy sum and it negated a significant tax liability while generating sizable compensation for both me and my firm, DSI. Two or three weeks later, I received a bottle of Dom Perignon at my office accompanied with a heartfelt thank you note from that client. Just weeks before that episode unfolded, I was standing in front of a student council at the university justifying reimbursement for gas mileage after an official business trip to Cal State Northridge. That is when I knew I was on to something.

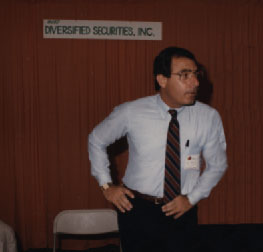

DSI in the old Home Savings Building

Our branch office in West Covina was…unusual. Hank was the manager but Mr. Schneider was still my ‘go to’ guy. There were six advisors and I was the only one in the bull pen while all others were in private offices. The suite was old and musty and desperately needed a make over the variety of which required a fire breathing dragon. Our desks were small, badly scratched and very old. The reception area was OK at best but required a receptionist who did not resemble the furniture. The carpeting was original and so badly worn that traffic patterns looked as though they had been painted. And the walls…they were covered with cheap reprints of Italian renaissance art purchased at a flee mart. The telephone system had its best days in the sixties which predated the advisors’ best days by two decades. I was a generation younger than the next person my senior. There was one brokerage secretary and one private secretary both of whom resembled that lady in American Gothic.

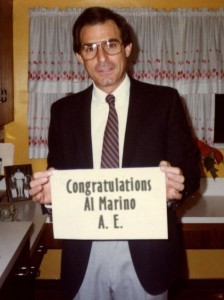

In 1989, I was promoted to Vice President and Resident Branch Manager of DSI, West Covina and brought in that fire breathing dragon and renovated our office and added new furniture, carpet, wall coverings and advisors. We were off and running and became the top producing DSI office for the next 18 consecutive years.

In the grand scheme of things, none of this really mattered. I came to learn that how you spend your time is way more important that where. This too is a lesson gleaned from my ol’ coaching days. One of the best high school gymnastics programs in the country was located in my new back yard…Baldwin Park, CA which is adjacent to West Covina. Located in the San Gabriel Valley, BP’s student population was primarily Latino and the area was and is challenged socio-economically. The high school had poor facilities, equipment and little to no supplies to support athletics. What they did have was a phenomenal coach who was dedicated to his sport, his school and most important, his athletes. John Draghi was a doctor on call. He was the original 24/7 guy who embodied that ‘whatever it takes’ attitude. When you combine a fierce competitive spirit with a hunger for technical knowledge and never look at a calendar or a clock, the end result is fairly predictable. His gymnasts were superb and were recruited to all of the major D1 universities countrywide who competed in our sport. His record of championships at both the high school and community college level are legendary. Draghi’s BP gymnastics program provided not only a model as to how to coach,but how to succeed…a lesson that has endured a lifetime.